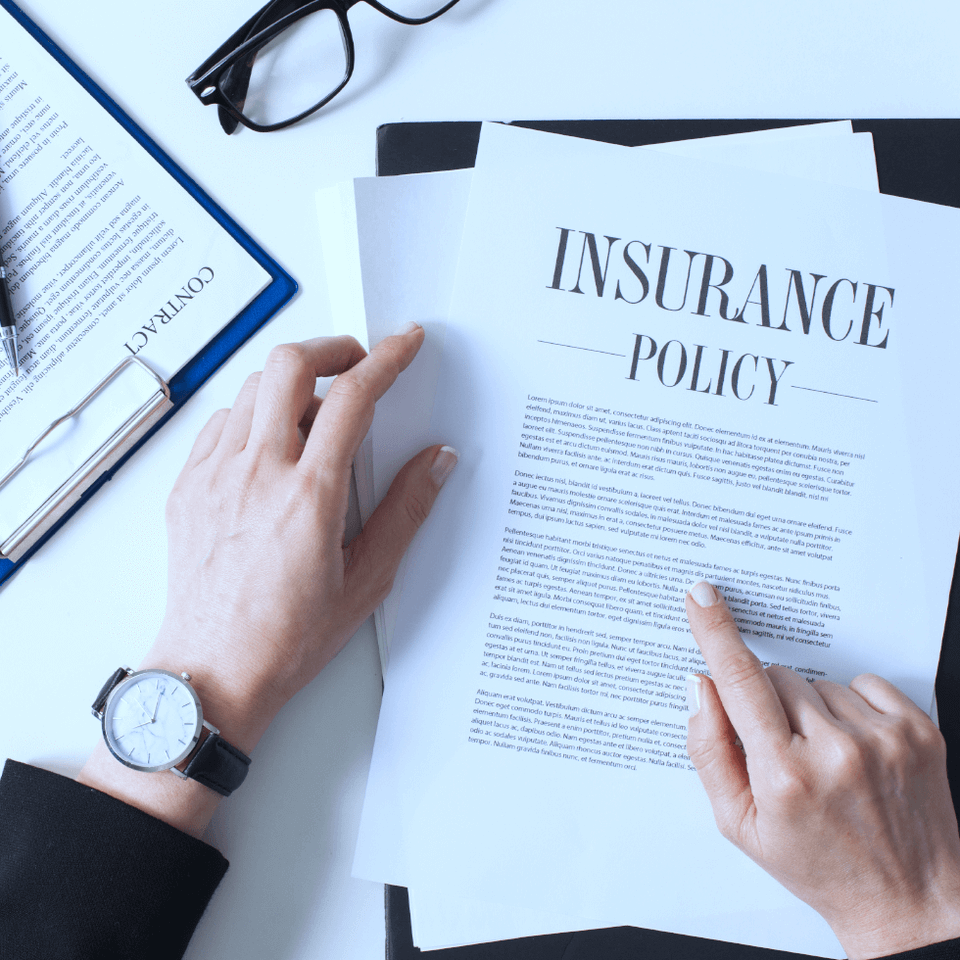

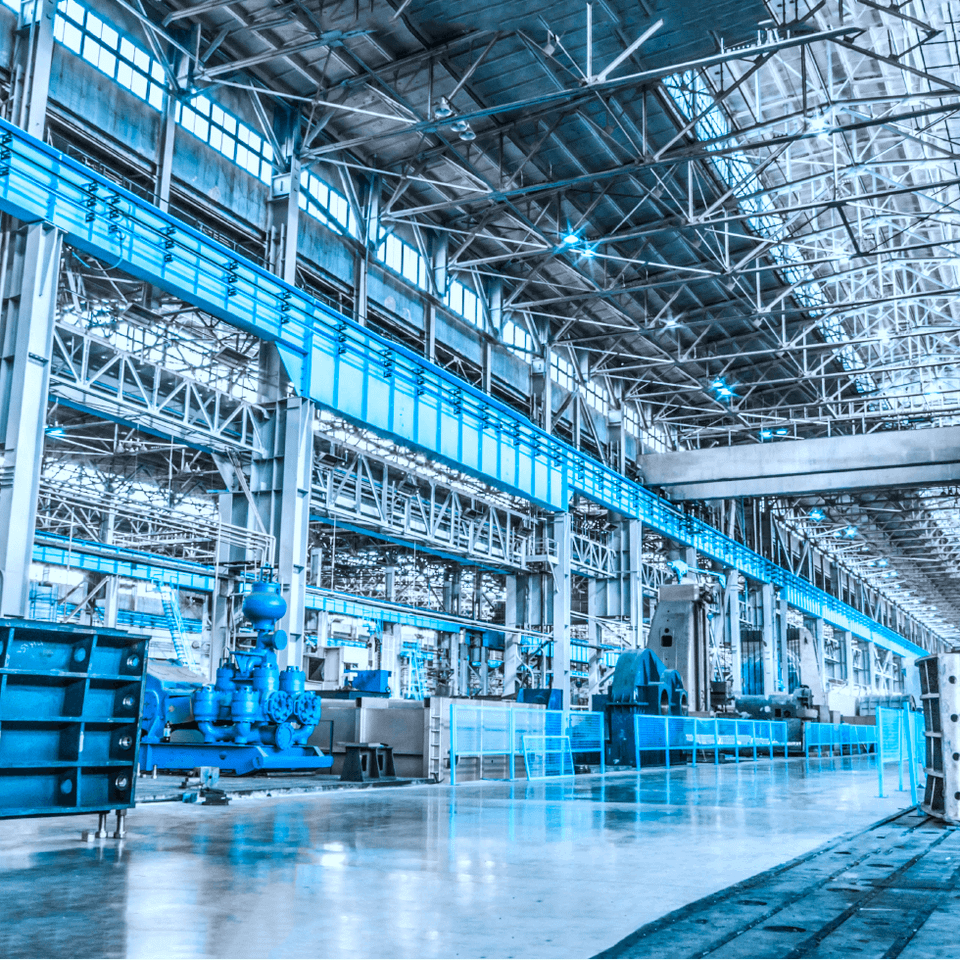

What is the best policy type for manufacturing insurance?

Depending on the size of your business and what you are manufacturing, you can structure your insurance policy on a business owners policy (BOP) or commercial insurance package policy.

Our goal will always be to structure your business insurance with the best coverage at the best value.